Concrete Pumping Holdings Inc (NASDAQ: BBCP) is a concrete pumping services provider in the United States and the United Kingdom. Founded in 1983 in Colorado, BBCP has a market capitalization of $400 million and generated $315 million in revenues in 2021.

Business Overview

Concrete Pumping Holding is a provider of concrete pumping services and concrete waste management services in the United States and the United Kingdom operating through four brands across both geographies: Brundage-Bone Concrete Pumping (U.S.), Capital Pumping (U.S.), Camfaud (U.K.), and Eco-Pan (U.S. and U.K.). Concrete pumping is a highly specialized method of concrete placement that requires skilled operators to position a truck-mounted, fully articulating boom for precise delivery of ready-mix concrete from mixer trucks to placing crews on a construction site. During the concrete placement process, concrete waste is produced, creating an opportunity for an additional service offering focused on waste management. Concrete Pumping Holdings owns and operates a fleet of Truck-Mounted Boom Pumps, Placing Booms, Eco-Pan Trucks, Stationary Concrete Pumps, Telebelts, and Concrete Washout Pans that help construction companies in the concrete placement and concrete washout processes, delivering cost-saving solutions, shortening concrete placement times, and enhancing worksite safety, ultimately improving the overall quality of construction projects.

Concrete Pumping Holdings operates through four segments: U.S. Concrete Pumping, U.S. Waste Management Services, U.K. Operations, and Corporate.

U.S. Concrete Pumping: Under the Brundage-Bone and Capital Pumping brands, the U.S. concrete pumping services segment represents approximately 70% of total revenues. With a fleet of 780 equipment units and a diversified footprint of 90 locations across 19 states, both companies offer services on a time and volume basis based on the duration of the job and yards of concrete pumped.

U.S. Concrete Waste Management Services: Under the Eco-Pan brand, the U.S. concrete waste management services segment represents approximately 10% of total revenues. With a fleet of 90 trucks and over 6,000 custom metal pans or containers for construction sites from 17 locations in the U.S., Eco-Pan provides full-service, cost-effective, regulation-compliant solutions to manage environmental issues caused by concrete washout.

U.K. Operations: Under the Camfaud and Eco-Pan brands, the U.K. operations segment approximately 15% of total revenues. With a fleet of 380 equipment units served from 30 locations, both companies provide services similarly to U.S. operations.

Corporate: the corporate segment represents a small part of revenues generated through intercompany leasing of real estate to certain U.S. concrete pumping branches.

Concrete Pumping Holdings serves mainly the commercial & infrastructure end markets which are larger, more complex, and more profitable. Additionally, a smaller percentage of revenues comes from the residential market, which is more cyclical and less profitable. The company’s national footprint, end market diversification, and economies of scale allow BBCP to effectively allocate resources across multiple construction sites, deploying equipment and operators to markets that are more profitable and indicate higher demand. Moreover, the complementary waste management service creates significant cross-selling opportunities, providing customers with a one-stop solution for their concrete washout needs.

Concrete Pumping, Concrete Washout & Fleet

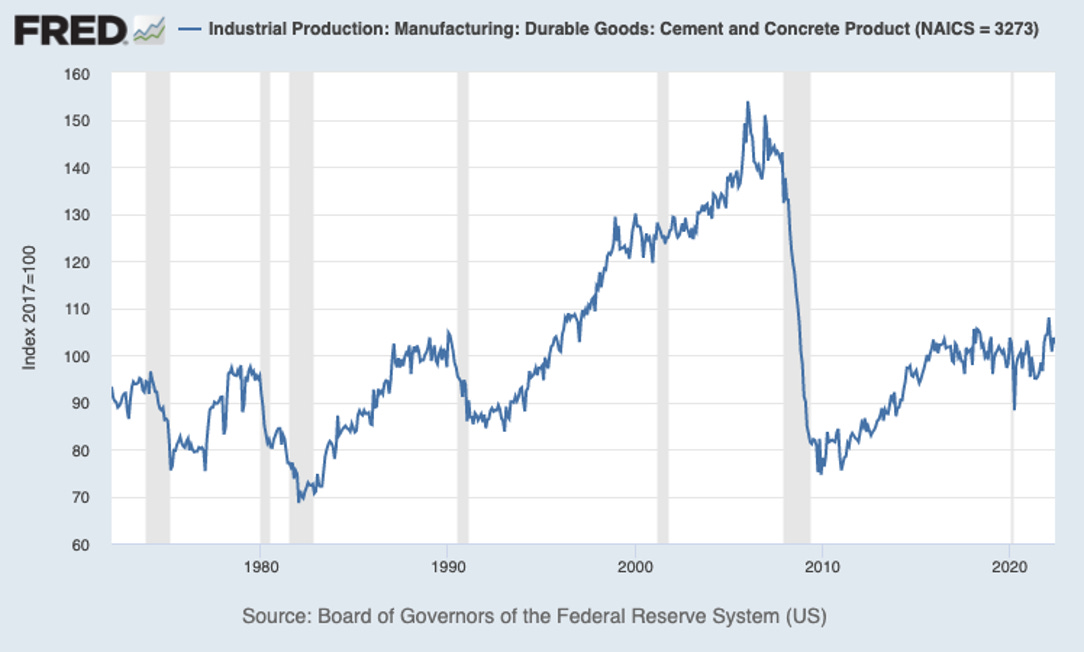

Concrete is a basic building element for modern construction, made from a mixture of paste and aggregates, or rocks, that is used in every construction project in one form or another to build homes and buildings, roads and highways, and other large and complex infrastructure like dams, bridges, rail systems, airports, and electric grids. The U.S. is the third largest cement producer in the world, only behind China and India, growing around 2% per year with approximately 90 million tons of cement produced in 2021. Despite the recent growth in manufacturing output, concrete production is still below historical levels. China, for example, produced about 2,500 million tons of concrete in 2021, 27x more than the U.S. Overall, the U.S. cement industry’s growth continues to be constrained by closed or idle plants, underutilized capacity, production disruption from plant upgrades, and all recent disruptions caused by COVID Such as the increasing costs for material and service inputs, labor, and production shortages, ongoing logistical and shipping issues, and supply chain disruptions.

In the next decade, investments in infrastructure are expected to grow significantly as the new Infrastructure Investment and Jobs Act is creating financial incentives to increase concrete production and construction activities in the country. Under the new act, $110 billion of new funds will be deployed for the upgrade, repair, and modernization of roads, bridges, airports, power grids, and water facilities creating job opportunities and demand for specialized services in the construction sites. The Portland Cement Association (PCA) expects that the construction projects that are directly related to the new act will start in Early/Mid-2022 as there are dependent on Federal & State paperwork, Bid Letting & Review processes, and Contract Awards to Construction decisions that are still in progress. In sum, from 2022 to 2028, the concrete/cement market is expected to grow at a CAGR of 5.1%, and the construction industry is expected to grow at a CAGR of 4.9%.

In the current inflationary environment with higher labor and material input costs, time and effectiveness are becoming paramount in construction sites. Under normal conditions, freshly ready-mix concrete must be placed within 1 hour of discharge from the truck-mixer. Concrete pumping equipment is critical for any construction project that requires effective use of ready-mix concrete, increasing pouring speed and efficiency because pumping machines have an uninterrupted influx of concrete and can place concrete faster than construction workers, eliminating the need for extra labor carrying concrete baches manually from the truck-mixer to the placement location. A single skilled pumping operator can handle the whole concrete placement process. In addition, concrete pumping ensures higher accuracy and quality in concrete pouring, decreasing wastage and delays in the pouring process, and increasing concrete strength as it requires less amount of water compared to other concrete pouring techniques.

When the concrete pouring process is completed, the chutes of ready-mixed concrete must be washed out to remove the remaining concrete before it hardens. Equipment, trucks, and tools also must be washed down. In the last two decades, laws and regulations were created to protect construction workers and the environment. Concrete washout water is a slurry containing toxic metals that can cause skin irritation and eye damage. In addition, if the washout water is dumped on the ground, it can run off the construction site to adjacent roads and enter roadside storm drains, which discharge to surface waters such as rivers and lakes. Concrete waste management services are increasing in demand across construction sites because companies must comply with regulations and by hiring a service provider, companies can focus on their core operations, minimizing costs and risks associated with the washout activity.

Concrete Pumping Holdings owns and operates a fleet consisting of 1,517 concrete pumping and waste management equipment and has approximately 940 equipment operators and mechanics across the U.K. and the U.S. The company owns 908 Mounted-Truck Booms (from 15m to 52m+), 411 Stationary Booms, 87 Placing Booms, 17 Telebelts, and 94 Eco-Pan Waste Management Trucks. The average life of the fleet is approximately 9 years old and most of the fleet has a useful life of 20 to 25 years. BBCP sources concrete pumping equipment from three supplies: Schwing, Putzmeister, and Alliance. Concrete pumping equipment is expensive, varying from $30 thousand for stationary booms to $800 thousand for 52m+ truck-mounted booms. Moreover, on average a concrete pump operator makes $83 thousand per year and is considered a highly skilled machinery operator. To become a pump operator, a person must obtain a commercial driver’s license, and become certified by the national commission for the certification of crane operators (NCCCO) in the Concrete Pump Operator certification program (CCO). Once an operator is certified, it is valid for five years and operators must recertify during the 12 months before the certification’s expiration date. In general, concrete pump operators are much more specialized construction workers and concrete pumping equipment is costly. In the last quarter, the company’s equipment on the Balance Sheet was valued at $420 million.

Acquisitions & Leadership

Concrete Pumping Holdings has acquired over 65 companies since 1983 with an average estimated acquisition adjusted EBITDA pre-synergy multiple of less than 5x. As the biggest company in the U.S. and U.K., BBCP benefits from its scale to increase the target’s EBITDA margins through utilization increases, price optimization, Capex and fuel purchasing discounts, and operating expense synergies. BBCP focuses on acquiring smaller businesses with experienced management, skilled operators, strong customer relationships, and a well-maintained fleet. The company’s biggest acquisition happened in 2019 when Capital Pumping was acquired for $130 million. Capital Pumping was the company’s biggest competitor, leading the concrete pumping services in Texas with highly trained pump operators, experienced mechanics, high-quality pumping equipment, and a strong customer base.

“The purchase of Capital Pumping is a unique opportunity that is consistent with our acquisition strategy and adds a well-run business that shares our core values of safety, people, and reliability,” Bruce Young, CEO of Concrete Pumping Holdings.

The acquisition of Capital Pumping was announced and closed in 2019, before COVID. The combination of COVID and this acquisition has put the company’s balance sheet under a lot of stress. Consequently, management has worked since then to deleverage the balance sheet and create more liquidity.

Concrete Pumping Holdings is led by Bruce Young since 2008. Before that, the CEO managed the concrete pumping operations for Brundage-Bone from 2001 to 2008 and served as CEO of Eco-Pan since the company’s inception in 1999. Bruce started his career on the construction site in 1980, operating pumping machines. Since then, he has gained experience working in every key aspect of the concrete pumping business, leading both the concrete pumping and the waste management operations. Likewise, other executives have similar work experience, with many working in different companies owned by BBCP or in other companies in the construction industry.

Investment Thesis

Concrete Pumping Holdings operates in an industry with high barriers to entry and has an attractive business model with low risks. The company pass-through concrete as a service and does not purchase, transport, or own any concrete, having no liability from bad concrete or spillage or exposure to commodity inventory risks. Additionally, the operational costs related to the company’s service offering are low as only one operator and one pumping equipment are sufficient to perform the job. According to management, concrete pumping is gaining share when compared to other placement methods, from 20% in the early 2000s to 35% in 2021. Moreover, the unit economics of the concrete pumping business is highly attractive, generating on average 25% Unlevered ROI with a 4 to 5 years payback period. When it comes to the waste management segment, it also has limited risks as the company does not have any ownership of waste and is not responsible for filling the washout pans or any spillages that occur on site. The total market opportunity for Eco-Pan in the U.S. is +850 million., BBCP has penetrated around 4% of the market and expects to grow low double digits in the next years. This segment has also compelling unit economics generating on average 54% Unlevered ROI with a payback period of 2 to 2.5 years.

Furthermore, BBCP operates in multiple locations in both the U.S. and the U.K., which creates advantages over its competitors because the company can deploy equipment faster and cheaper than other smaller shops. Additionally, the returns on invested capital are higher as scale increases because BBCP has a higher level of machine utilization while smaller shops have limited growth opportunities as their small scale means that the access to capital is restricted, curbing their ability to acquire new machines that can cost up to $800 thousand.

In addition to a strong and resilient business model, increasing construction costs are beneficial to the company because construction companies seek to minimize costs and maximize operational efficiency. Even though these companies have the choice and resources to acquire and operate or rent and operate pumping machines, they prefer to not do so because it is not efficient and results in lower returns on invested capital.

In the case of construction companies acquiring pumping equipment: Construction sites are unique in land, depth, and layout, therefore certain equipment that is suitable for one site may be suitable for another site. A company also must have operators that are skilled in different types of equipment. In addition, Concrete pumping equipment is expensive to acquire, costing as much as $800 thousand, and costly to maintain if the utilization rate is low.

In the case of construction companies renting the pumping equipment, a similar logic applies. Different machines are required for different construction sites; therefore, a company must have construction workers that are certified operators and capable of operating multiple types of pumping machines efficiently.

In general, construction companies are better off allocating part of their resources to hiring a service provider that will minimize the risks of concrete pumping failure and construction site disruptions.

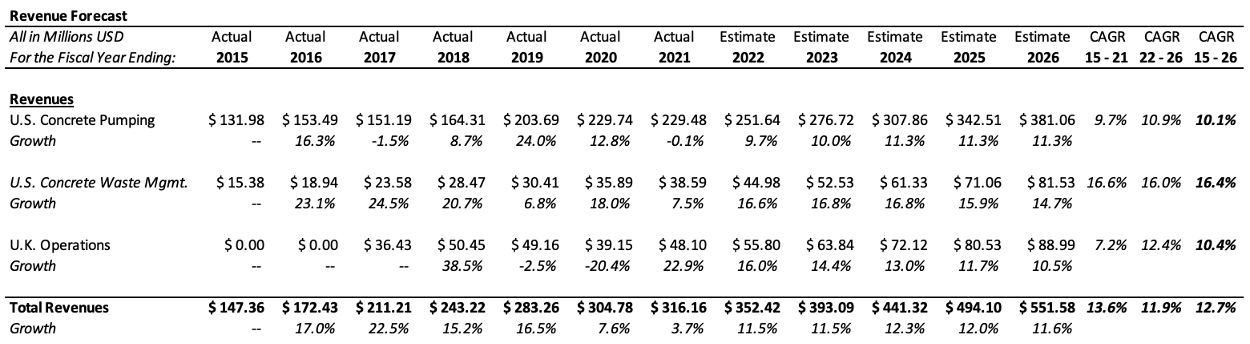

From 2015 to 2021, Concrete Pumping Holdings has done a great job increasing revenue and income across all business segments. The U.S. Concrete Pumping segment has a more consolidated market, providing steady and predictive growth opportunities with lower margins. The U.K. Operations segment, on the other hand, is an unconsolidated market with significant expansion opportunities that will provide double-digit growth and higher margins. The U.S. Waste Management segment presents the biggest growth opportunities. It is a high-demand market with a few service providers that may provide mid double digits revenue growth opportunities and high margins.

Looking thoroughly at the company’s financials, it is clear that they have had a difficult time maintaining consistent EBITDA margins and revenue growth. In the last 4 years, BBCP has experienced major operational disruptions caused by COVID. At the beginning of 2019, the company acquired its major competitor, Capital Pumping for $130 million, creating a lot of stress on the balance sheet and operational distress because Capital Pumping was the second largest company in the industry. Despite all synergies, management was expecting difficulties in the integration process. When COVID happened later in the year, BBCP started to experience project delays and shutdowns (40% of U.S. operations were shut down in the fourth quarter). In 2020, when the construction industry in the U.S. gave signs of recovery, the U.K. Operations segment started to experience delays and shutdowns, impacting again the overall operations of the company. In 2021, the U.K. Operations segment started to recover, however, inflationary pressures and supply chain constraints started to appear in the U.S., once again delaying construction projects and slowing growth. Now in 2022 and henceforth, COVID-related issues and slowly easing and growth opportunities are reappearing in residential projects in some parts of the country and commercial and infrastructure projects in both the U.S. and U.K. markets.

Overall, BBCP had a rough path since it went public and yet the company grew and generated positive cash flows. In the next few years, BBCP will have the opportunity to grow strong as a result of the Infrastructure Act, the regained momentum in the construction industry, and all market opportunities in the U.K Operations segment and the Waste management services.

Model

Concrete Pumping Holdings discloses revenue by operating segments (U.S. Concrete Pumping, U.K. Operations, and U.S. Concrete Waste Management) and Geography (The United States and The United Kingdom). Revenues will be forecasted by operating segment, taking into consideration aspects like construction growth forecasts, economic growth, COVID-related issues, concrete & cement production, and legislation.

The model forecasted that revenues would reach $551 million in 2026, a CAGR of 11.9%. The top contributor to growth would be the U.S. Concrete Waste Management segment, growing at a CAGR of 16% from $44 million in 2021 to $81 million in 2026. The U.K. Operations segment would grow at a CAGR of 12% and the U.S. Concrete Pumping segment would grow at 10.9%. More specifically, the U.S. Concrete Waste Management would be also driven by cross-selling opportunities and further market penetration. When it comes to the U.K. and the U.S. Pumping segments, it would be also driven by the easing of inflationary pressures and the acceleration of construction projects. In general, revenue growth across all segments would be driven by the Infrastructure bill incentives and the construction industry recovery. Customer demand is expected to peak in 2023 and 2023. From 2024, more steady growth is expected to occur.

When it comes to the company’s operating margins, the model incorporated aspects such as management guidance, inflationary pressures, industry growth, integration costs, and economies of scale. For FY 2022, management has re-affirmed earnings guidance for revenue, EBITDA, and free cash flow.

“The Company continues to expect the fiscal year 2022 revenue to range between $360.0 million to $370.0 million, Adjusted EBITDA to range from $115.0 million to $120.0 million, and free cash flow to range between $55.0 million and $60.0 million.” Q2 2022 Earnings Call.

The model assumes conservatively that both EBITDA and free cash flow would be in the low range of guidance for 2022. Henceforth, margins are expected to expand in all operating segments as scale makes it cheaper to deploy machines and operators, and the demand for service increases. The Top margin contributors for total EBITDA margin expansion would be the U.S. Waste management segment and the U.K. Operations segment. As both segments become a larger part of the business, overall margins are expected to increase over the years. Addition drivers of margin expansion would be the easing of COVID-related inflationary pressures and efficient M&A integrations. The model assumes that margin expansion would happen in two phases with a rapid increase in 2022 and 2023, and then a steady and slowing margin expansion from 2024 to 2026.

When it comes to free cash flow, management has guided FY 2022 free cash flow ranging from $50 to $60 million. The model assumes that $42 million in free cash flow would be generated as a result of the current acquisition implementation costs. Starting in 2023, both free cash flow conversion and free cash flow margins would expand as the industry reconsolidates and management would have a more predictable view of operation costs and capital expenditures.

Valuation

After taking all revenue and operational cost forecasts into account, the valuation output includes two methods: a valuation multiples analysis and a discounted cash flow analysis. The exit EBITDA multiples are a combination of the company’s current multiples, management expectations, and peer multiples. The discount rate and terminal growth rate for the DCF analysis are a combination of a perpetual industry growth rate assumption and a WACC assumption.

The base case scenario assumes that the company in 2026 would generate $551.5 million in revenues, $193.9 million in EBITDA with a 35.2% margin, and $85.3 free cash flow with a conversion of 44%. The expected share price in 2026 with these assumptions and an exit TEV/EBITDA of 8.4x is $21.28, representing an upside of 199.7% and an IRR of 29.8% from 2022 to 2026.

The bear case scenario assumes that the company in 2026 would generate $524.0 million in revenues, $174.5 million in EBITDA with a 33.3% margin, and $69.1 free cash flow with a conversion of 39.6%. The expected share price in 2026 with these assumptions and an exit TEV/EBITDA of 5.8x is $9.46, representing an upside of 33.2% and an IRR of 7.1% from 2022 to 2026.

The bull case scenario assumes that the company in 2026 would generate $579.1 million in revenues, $213.3 million in EBITDA with a 36.8% margin, and $103.2 free cash flow with a conversion of 48.4%. The expected share price in 2026 with these assumptions and an exit TEV/EBITDA of 11.0x is $37.7, representing an upside of 431.0% and an IRR of 48.7% from 2022 to 2026.

The discounted cash flow analysis output applies a terminal growth rate ranging from 1.0% in the bear case to 1.5% in both base and bull cases. Additionally, it applies a discount rate ranging from 9.0% in the bear case to 8.0% in the bull case. The expected intrinsic value per share would range from $9.12 in the bear case to $11.3 in the bull case with an intrinsic value per share of $12.8 in the base case.

Risks and Conclusion

The risks related to an investment in BBCP are mostly a result of excessive leverage and macroeconomic conditions. The company has $ 400 million in debt at 6% due in 2026. The interest expense generated from this debt is a burden on the company’s income statement as it costs 6.9% of revenues. Management has said that they intend to pay down debt in the next couple of years reaching a 2.5x to 3.0x leverage ratio, however until that happens, there are still liquidity concerns related to the company. Moreover, despite the non-commodity risks, BBCP has exposure to macroeconomic and commodity price conditions. Severe recessions, inflationary pressures, or slowdowns in construction projects would impact the company’s ability to generate cash flows reducing the expected returns on investment in BBCP.

In sum, Concrete Pumping Holdings is a market leader in an unconsolidated market. The company benefits from its scale to acquire competitors, decrease operational and acquisition costs, and increase equipment utilization which ultimately increases return on invested capital. The concrete pumping industry has high barriers to entry associated with high equipment costs which limit the threat of new entrants in the market. A high-quality concrete pumping equipment, for example, may cost up to $800 thousand for a new company. In the last 4 years, the company has gone through turbulent times with project delays and shutdowns, inflationary pressures, and raised fuel costs, and yet has done a great job increasing revenues and operating income. Since the company went public, 2022 is the first year without any major operational or industry disruptions, therefore we can expect that management will do a great job as economic conditions improve in the next years. To invest. in BBCP, you need to believe that macroeconomic conditions in the next years will be better than they were in the last 4 years and that management will do a great job growing the Waste Management services which will lead to operating margin expansion, better free cash flow conversion and debt paydown. At current price levels ($7.10 per share), you are paying 7x EV/ Fwd EBITDA, 19x EV/ Fwd FCF, and 18x P/Fwd EPS for a company growing both revenues and free cash flow double digits per year.