Guidewire Software Inc (NYSE:GWRE)

Innovative P&C Software Solution

Guidewire Software Inc (NYSE: GWRE) is a leading provider of P&C cloud-based services. The core technology platform combines core operations, digital engagement, analytics, and artificial intelligence applications delivered as a cloud service or self-managed software.

I have a position in Guidewire at an average of $ 77 and plan to increase it as the market continues to slide.

Business Overview

Guidewire Software Inc provides a platform that supports the entire insurance lifecycle, including product definition, underwriting, policyholder services, and claim management.

InsuranceSuite via Guidewire Cloud consists of three core applications: PolicyCenter, BillingCenter, and ClaimCenter, which can be subscribed to separately or together, providing enhanced functionality and a standard data model across applications.

InsuranceNow: Cloud-based platform for P&C insurers that offers policy, billing, and claims management functionality to insurers that prefer to subscribe to a cloud-based, all-in-one solution.

PolicyCenter: Underwriting and policy administrator application that serves as a comprehensive system-of-record supporting the entire policy lifecycle, including product definition, underwriting, quoting, binding, issuances, endorsements, audits, cancellations, and renewals.

BillingCenter: Automates the billing lifecycle, enables the design of a wide variety of billing and payment plans, manages agent commissions, and integrates with external payment systems.

ClaimCenter: Offers end-to-end claims lifecycle management, including product definition, distribution, underwriting, policyholder services, and claims management.

The company sells proprietary cloud-based services and applications through subscription services and term licenses. The price of services and products are based on the amount of Direct Written Premiums (DWP) that will be managed by the platform. Subscription Services are sold on a subscription base with an initial term of between three and five years and Term Licences are sold with an initial two-year committed term.

The company recognizes that to extend its technology leadership in the global market and drive operating efficiency, it is essential to continue to invest in product development and cloud operations, introduce new products and services, and advance the ability to securely add cost-effective services in the cloud.

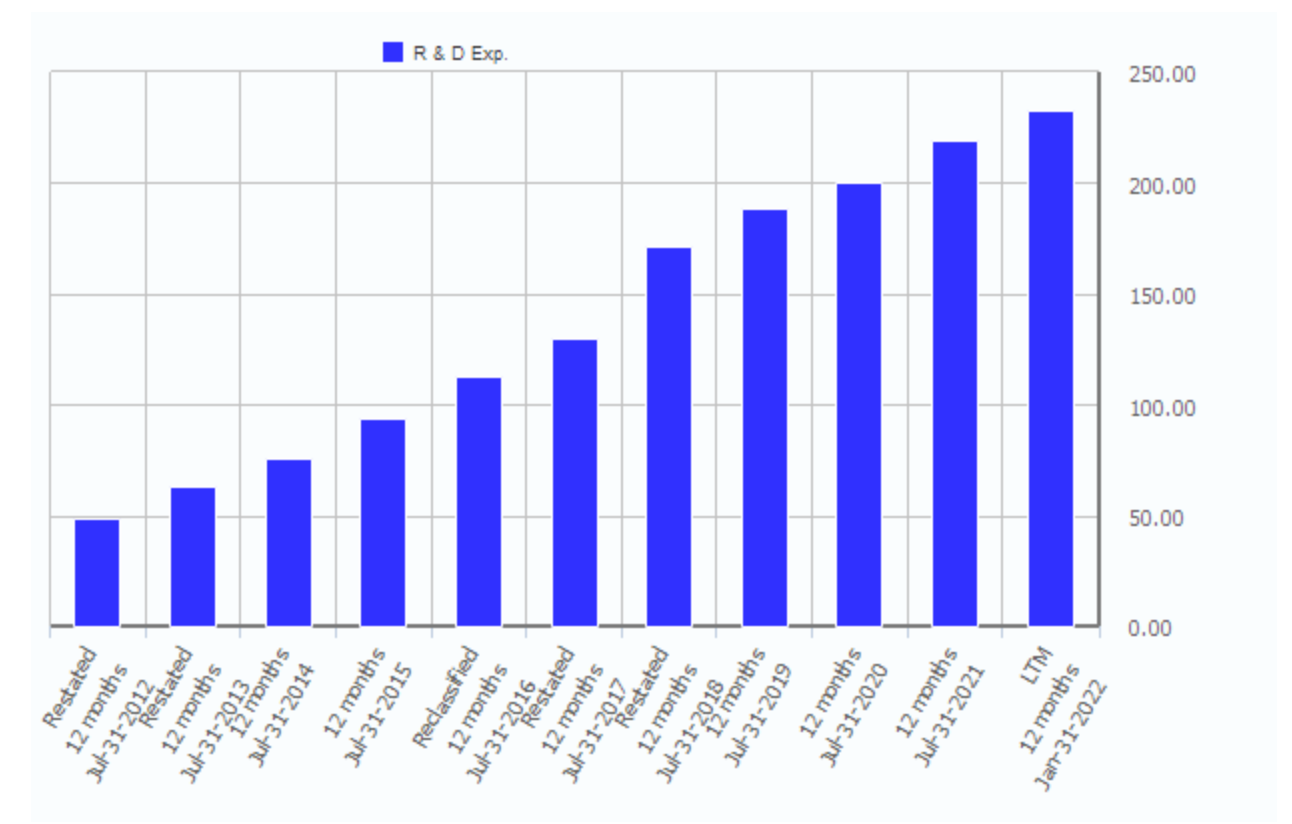

Over the last 10 years, GWRE has invested more than $1.5 Bn in R&D, corresponding to an average of 25% of total revenue. From 2012 to 2022, R&D has grown by 16.8% CAGR, and the company continues to express the intent to advance its R&D in the future.

Guidewire has launched a great number of new products over the last 10 years while increasing revenues in existing products and increasing overall client count, proving that the current phase of maximizing R&D has shown results.

To succeed in market penetration and product adoption, the company depends on the success of product implementation. SI Partners are essential to ensure that clients are served with the right combination of products and skills which leads to a smoother implementation phase and more efficiency. Guidewire maintains strong relationships with SI, consulting, technology, and other industry partners. These SI partners facilitate new sales and product implementation, growing customer relationships between the company, partners, and clients.

In the beginning, Guidewire represented the idea of transformation in the insurance industry and today is the change taking place. Marcus Ryu, now Chairman of the Board, previously held various executive roles and as CEO, led the company during its IPO in 2012. Marcus is one of the six founders of Guidewire, a visionary who believed that they could change a stagnant industry. As the company grew, he realized that he had to pass the baton to a more experienced person, so he stepped down as CEO and joined the board of directors as the new chairman. Mike Rosenbaum joined the company in 2019 as the new CEO after working at Salesforce as an EVP of Product, bringing project management, go-to-market, and Cloud experience. Mike is the correct choice to lead the company in a new direction into a completely cloud-based solution.

Both the Executive Team and Board of Directors have extensive experience not only in the insurance industry but also in technology, cloud, financial services, and Innovation. Most of the board and the new management have joined the company in 2019 with the new CEO. This new management has yet to prove they can take GWRE to the next level, however, until now, they have done a great job launching new products and accurately allocating capital. The company has invested in private companies, acquired other businesses, and announced share buybacks.

In 2021, Hazardhub, an insurtech provider of property risk insights to the P&C industry, was acquired for $ 52.8 mm. The company curates, analyze, and distills data to deliver a comprehensive catalog of risks that may damage or destroy property.

“Embedding HazardHub’s comprehensive property risk data service into Guidewire’s industry-leading platform will drive tremendous value for our customers and the P&C insurance industry.” Mike Rosenbaum, CEO of Guidewire.

“We see joining Guidewire as the best way to get our hazard data and risk scores into more insurer workflows to positively impact more insurers and policyholders” Bob Frady, co-founder and CEO, HazardHub.

The acquisition of Hazardhub will enhance the range of products Guidewire can offer on its platform. At its current state, Guidewire can use its scale to acquire new businesses and increase its product mix.

As stated before, the new board members and managers who joined in 2019 bring extensive experience in technology and product innovation, especially Catherine Lego and Paul Mang with experiences as angel investors, early-stage tech investments, and product innovation strategy. The new wave of early-stage technology investments made by guidewire shows the board and management's expertise in practice. Overall, the company has a great and diverse management team ready to lead the company through the cloud transition and business expansion.

Industry Overview

Unlikely other industries, the insurance company, especially the P&C insurance industry has an established history of being conservative regards to underwriting and investment practices. Many companies in the industry take the approach of “if not broken don’t fix it” and do not implement new processes and technologies. As a result, a significant part of the industry still runs on very outdated software which may be costly and inflexible. It is essential that insurance companies upgrade their technology and processes, not only because it is outdated and expensive, but also because they are often vulnerable to fraud and cyber-attacks.

According to the company’s investor presentation and industry analysis from Swiss Re Group, the total addressable market for GWRE, is roughly $ 2.300,0 Bn in 2021 and is expected to grow at a 4.0% CAGR to $ 3.300 Bn in 2030.

Currently, GWRE has penetrated only 0.032% of the market opportunity and due to new product releases the TAM is expected to continue to expand.

The insurance industry has a positive growth outlook, but inflation poses a near-term macro risk. Swiss Re Institute forecasted that the demand for insurance is set to grow in the long-term, having Property as the fastest growing line of the P&C business.

According to the study presented by Swiss Re, P&C premiums will grow on average by 4.3% per year. Advances in technology, ongoing urbanization, and climate change will re-share P&C risk pools. The main drivers for this growth will be pure economic development across the globe. In property, specifically, climate risks will raise claims and premiums. Historically, the stage of a country and the economic development have a high impact on the premium growth. A higher GDP per capita usually translates to higher gross written premiums per capita. Emerging markets represent only a small share of GWRE’s current revenue and would be an excellent opportunity for future growth.

Although the P&C industry is reluctant to adopt new technologies, as the world advances and cloud services become more adopted, insurers will have to evolve as a matter of survival. GWRE is the leading company in the industry and is prepared to capture the market as new companies realize the importance of technology.

Investment Thesis

To build an investment thesis for Guidewire, firstly, it’s important to understand where the company came from, where it is now, and where it is going. This is the “third act” in the company’s history:

The Beginning (2001 - 2011): In this period the company was born and a minimum viable product was created. The company won its first clients and an enterprise structure was formed.

IPO and Industry Consolidation (2012 - 2019): The company went public, raised capital to grow the business, became known in the insurance industry, and Marcus Ryu stepped down as CEO and joined the Board as Chairman.

Cloud-Based Business Model and Mike Rosenbaum (2019 - Now): The company is successfully transitioning to a cloud-based business model, Mike Rosenbaum joined as the new CEO to escalate the business.

Guidewire has invested for the past 20 years, and now is accelerating customer acquisition. The new “phase” of the business aligns with the transformation happening in the insurance industry. Over the last few years, insurers have increased their investment in technology because they realized that investments translated to future growth and efficiency. According to Deloitte, insurance companies expect mostly to increase spending on Artificial Intelligence, Cloud, and Data Privacy. From 2012 to 2020, technology’s average share of operating costs rose by 36% for P&C.

A strong headwind for GWRE is the modernization of core systems: Insurers are finally changing their core systems due to the requirements of the digital era.

Guidewire Software is the market leader providing such systems to insurers. As the market leader, with a proven product, high-level execution, and an already robust client base, the company is the best positioned to participate in these transformational projects.

When a legacy insurance company decides to replace its core systems (+20 years old COBOL-based software), such projects can take from five to ten years. When the implementation process is completed, Guidewire most definitely has managed to acquire a lifetime customer due to the extremely high switching costs and the complexity of changing from Guidewire to its only competitor Duck Greek which focuses on low-tier customers.

As soon as a new customer is done with the implementation process, ARR is guaranteed and the cost associated with that specific client goes down to maintenance and/or further developments. Over the past 10 years, the growth rate of ARR is roughly 22.0% and as the company continues to increase the value-added to its customers, ARR is expected to keep growing.

If guidewire manages to acquire only 0.1% of all the Direct Written Premium market opportunities by 2030, it would represent a total revenue of $ 3.5 Bn.

Valuation Analysis

GWRE has a Market Cap of $ 6.4 Bn USD and an LTM revenue of $ 764 mm. The company has grown revenues at a CAGR of 14.9% from 2010 to LTM 2022 while in most years remaining both Cash from Operations and Free Cash Flow Positive.

Like any tech company, Guidewire depends on scaling the business to show profitability. However, the company has already proven that it can be profitable in the past even while heavily investing in Research and Development and CapEx. Recently, as the business is transforming to cloud and Covid hit, FCF and operational margins went down, but soon enough margins will come back to what they were in previous years, and with a successful cloud-based business, margins tend to be even higher.

In the last 5 years, the company has been valued at a TEV/NTM Total Revenue multiple of 10x, and the current multiple sits at 7.38x. Despite the current market multiple compression, Guidewire is not expensive at all, considering the value-added and the potential the company has to generate Free Cash Flow in the coming years. Assuming that the Revenue Multiple in 2030 would vary from 3.40x to 10.90x and the company would penetrate from 0.05% to 0.10% of the Total Direct Written Premium Market Opportunity, the company would reach the following stock prices and respectfully investment CAGR:

According to the sensitivity analysis, the mean share price in 2030 is $ 210.91 at a CAGR of 13.4%, and the median share price is $ 197.04 at a CAGR of 12.4%. In the best-case scenario, GWRE manages to capture 0.1% of the total DWP opportunity and is valued at a 10.90x revenue multiple achieving a share price is $ 428.90 at a CAGR of 23.9%.

Risk Analysis

The major risks for Guidewire are:

The insurance Industry remains stagnant: Despite the recent efforts to invest in technology, the insurance industry is well-known for its lack of investments in technology. In the case of non-investment, Guidewire would have a hard time escalating the business to become profitable again.

Failure to Transition and Failure to Deliver: Failure to transition successfully to the cloud-based business model would pose a threat to Guidewire’s current clients due to the criticality of the service the company provides; Failure to deliver a high-quality cloud product would result in difficulty to increase ARR and escalate the business to profitable levels.

Although Guidewire is well-positioned to serve the insurance industry, the company still relies on the pace insurers will take to change their core systems.

Conclusion

Guidewire Software presents a compelling investment opportunity. The company has a strong business model that translates into ARR and high margins. Despite the current moment of transformation to the cloud, the company has all the tools to deliver a high-quality product. At the current price, trading at 7.38x TEV/ Revenue, the investment could generate outstanding results. Sooner or later, the insurance industry is gonna evolve and Guidewire will be there to guide this transformation.